what is fsa/hra eligible health care expenses

Ad Custom benefits solutions for your business needs. An HRA is an employer-funded plan that reimburses employees for medical care expenses and allows unused amounts to be carried forward.

Fsa Hra Hsa Eligible And Ineligible Expenses Cigna Hsa Health Savings Account Expensive

Either you or your employer can deposit money into it for future health care expenses.

. Your employer determines which expenses are eligible for reimbursement based on a list of IRS-approved eligible expenses. The new CARES Act expands eligible expenses for HSAs FSAs and HRAs. Please save your receipts and other supporting documentation related to your HC FSA expenses and claims.

A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. Ad CareCredit Helps To Make The Medical Procedures You Want Possible. For the most part you can use your FSA HSA or HRA to cover copayments deductibles certain drugs and some other health care costs up to a total of 2550 per year.

Dependent care fsa eligible expenses 2021. The fsa eligible expenses 2022 pdf is a document that lists the types of health care expenses that are eligible for FSA. Contributions can be written off for the employer and can be used tax-free for the plan participants.

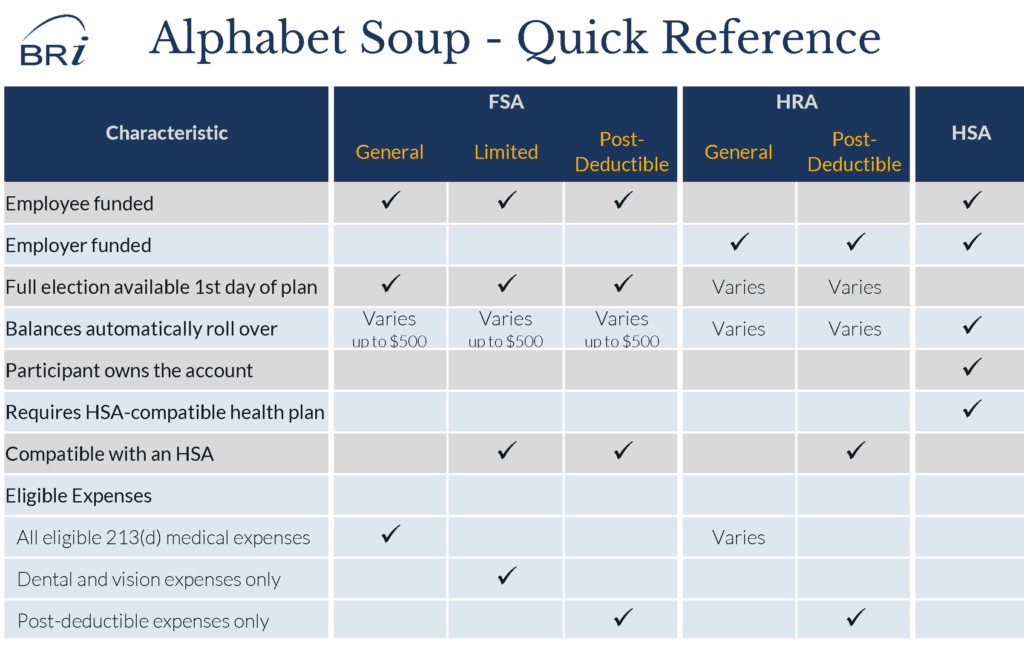

Your employer determines which health care expenses are eligible under your HRA. Reimbursable with an FSA HRA and HSA without a prescription. FSA HRA HSA Definition A flexible spending account FSA is an employee andor employer-funded account for qualifying medical expenses.

Refer to your enrollment materials for the details of your plan. HRA - You can use your HRA to pay for eligible medical dental or vision expenses for yourself or your dependents enrolled in the HRA. EHealth Offers Simplified Insurance Buying Experience For Consumers.

Plan Management HRA Eligible Expenses Here are examples of medical services treatments and over-the-counter OTC medications you can purchase using your health reimbursement account HRA. The federal government lists qualified medical expenses that can be covered by these savings and reimbursement accounts in its Publication 502. HRA Eligible Expenses Table.

Please check your plan documents for eligible expenses. Feminine hygiene products are now qualifying medical expenses. Health Savings Accounts HSAs Health Flexible Savings Accounts FSAs and Health Reimbursement Arrangements HRAs are all tax-advantaged so the IRS defines the types of expenses that you can pay for with these accounts.

Learn More And Apply Today. See Drugs and medicines. Ad Get Small Business Insurance That Protects Employees and Saves You Money.

Medical services and treatments. Generally qualified expenses include doctor visits medications medical equipment and dental and vision care for you. An eligible HRA expense is any healthcare expense incurred by an employee their spouse or dependent that is approved by the IRS and eligible for reimbursement under your specific company plan.

The IRS determines which expenses can be reimbursed by an FSA. Includes various items that assist individuals in performing. Health reimbursement arrangement HRA.

An HRA is an employer-owned account that can be paired with any type of health plan. An HRA is funded solely by the employer and the reimbursements for medical expenses up to a maximum dollar amount for a coverage period arent included in your income. Refer to your plan documents for more details.

You can use your account to pay for a variety of healthcare products and services for you your spouse and your dependents. Qualifying Health Care Expenses. If you need to get reimbursed dont forget to keep your receipts.

Fsa eligible expenses 2021 wageworks. You dont pay taxes on this money. Health Care FSA dollars can be used to reimburse you for medical and dental expenses incurred by you your spouse or eligible dependents children siblings parents and other dependents which are defined in your Plan Documents.

But see Dependent care expenses and Disabled dependent care expenses. Eligible fsa expenses 2022. This means youll save an amount equal to the taxes you would have paid on the money you set aside.

Elevate your health benefits. Remember the easiest way to pay for eligible expenses is with your MyChoice Accounts debit card. Bactine Potentially qualifying expense Must be prescribed.

Ace Qualifying expense Bandages for torn or. Employers make the plan contributions and funds can be used to pay for qualified healthcare expenses. Medical FSA HRA HSA.

16 rows You can use your Health Care FSA HC FSA funds to pay for a wide variety of health care products and services for you your spouse and your dependents. HRA dollars can only be used to pay for eligible medical expenses incurred by employees and their dependents enrolled in the HRA. You can now use your HSA FSA or HRA for over-the-counter OTC medications without a prescription.

Easy implementation and comprehensive employee education available 247. Health Care FSA dollars can be used to reimburse you for medical and dental expenses incurred by you your spouse or eligible dependents children siblings parents and other dependents which are defined in your Plan Documents. Get a free demo.

Not all HRA plans will cover OTC vision dental or pharmacy expenses. Designed For Your Health And Wellness Needs. Not a qualifying expense Babysitting child care and nursing services for a normal healthy baby do not qualify as medical care.

FSA HSA and HRA Expenses Covered. The IRS determines medical dental and vision expenses that are eligible with a health care FSA as well as a medical HRA that allows eligible items as listed in IRS publication 502. Fsa eligible expenses 2021 pdf.

See the Common Over-the-Counter OTC Medications section below for examples. HRA dollars can only be used to pay for eligible medical expenses incurred by employees and their dependents enrolled in the HRA. Employers may make contributions to your FSA but.

The IRS may request.

The Perfect Recipe Hra Fsa And Hsa Benefit Options

Fsa Hra Eligible Expenses Mychoice Accounts Businessolver

Eligible And Ineligible Fsa Items Flex Administrators Inc

New Hsa Fsa Eligible Expenses Healthcare Items To Buy Right Now Modern Frugality

Hras Are One Of The Tax Favored Health Plans That Employers Can Offer Their Employees Some Others That E Health Savings Account Savings Account Finance Saving

Hra Vs Fsa See The Benefits Of Each Wex Inc

5 New Expenses Eligible For Your Hsa Fsa Funds Advantage Administrators

Common Hsa Hra Fsa Eligible Expenses

What Is A Dependent Care Fsa Wex Inc

Understanding The Differences Of Fsa Hsa Hra Accounts Medmattress Com

Hsa And Fsa Accounts What You Need To Know Readers Com

Common Hsa Eligible Ineligible Expenses Optum Bank

List Of Hsa Health Fsa And Hra Eligible Expenses

Eyegiene Insta Warmth Compresses Are Eligible For Fsa Reimbursement Dry Eye Treatment Health Insurance Plans Dry Eyes

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Fsa Eligible Items Top Tips And What You Can Purchase At A Glance

Health Care And Dependent Care Fsas Infographic Optum Financial